If you want full control over your finances and future, look no further than Merrill Edge. Their platform gives you a wide range of options. You can trade stocks, bonds, ETFs, create investment plans and strategies, and also enjoy a full range of mutual funds.

Merrill Edge puts a focus on dedication to its customers. Strong relationships between customers and employees are the foundation of their business. This is achieved by gathering experience from over two million satisfied customers.Customers use helpful tools and research results to improve their investment knowledge and decision making.

What differentiates Merrill Edge from its competitors is the need to provide each of their users with exactly the type of investment strategy they need. They do this by creating informed portfolios, limiting risks and specifying investment time frames.

Here I will try to show all the necessary information about Merrill Edge and its products.

Merrill Edge platform – tools and accounts

Merrill Edge provides their users with simple investing and banking tools. They combine their research and insights with those from Bank of America and Merrill Lynch, with whom they cooperate closely. You can follow all of your investments and your Bank of America account on the same page using this platform. This feature is also available on mobile devices. You can transfer money between your different accounts in one simple step.

When it comes to helping less experienced users, The Financial Solutions Advisor is a type of service that you can’t find in other places. He is there to sort out your priorities and to create a sound investment plan that suits your personal needs. You can find your Advisor in over 2,000 Bank of America centers.

Merrill Edge also provides educational courses. With this, users can develop a better understanding of trading stocks, bonds and ETFs.

There is a number of useful tools provided by the Merrill Edge platform. These tools are there to help you define and reach your investment goals. Tools that are included in the package are:

- security profiles

- MarketPro – advanced training options tool

- real-time stock market analysis

- detailed profiles of companies

- customisable stock screeners

- third-party analytics and insight

- mobile investing

When it comes to accounts, Merrill Edge offers a few different types:

- Personal banking accounts – organized to your needs

- Online brokerage accounts – for personal investments or as a custodial account

- Small business accounts – great for managing finances for your business

- Retirement accounts – with different tax reduction options and deferred growth

- College accounts – highly flexible investment planning

All of these groups have more detailed options. You can always choose the one that will best suit your needs.

Pricing and mobile trade opportunities

Opening up an investment account with Merrill Edge may cost you up to 600$, depending on the type and account features. You can see the full pricing details on their website.

Merrill Edge puts a focus on simple pricing conditions. They offer a flat rate of $6.95 for equity, and ETF trades with no trade or balance minimum. Some other examples of fees include:

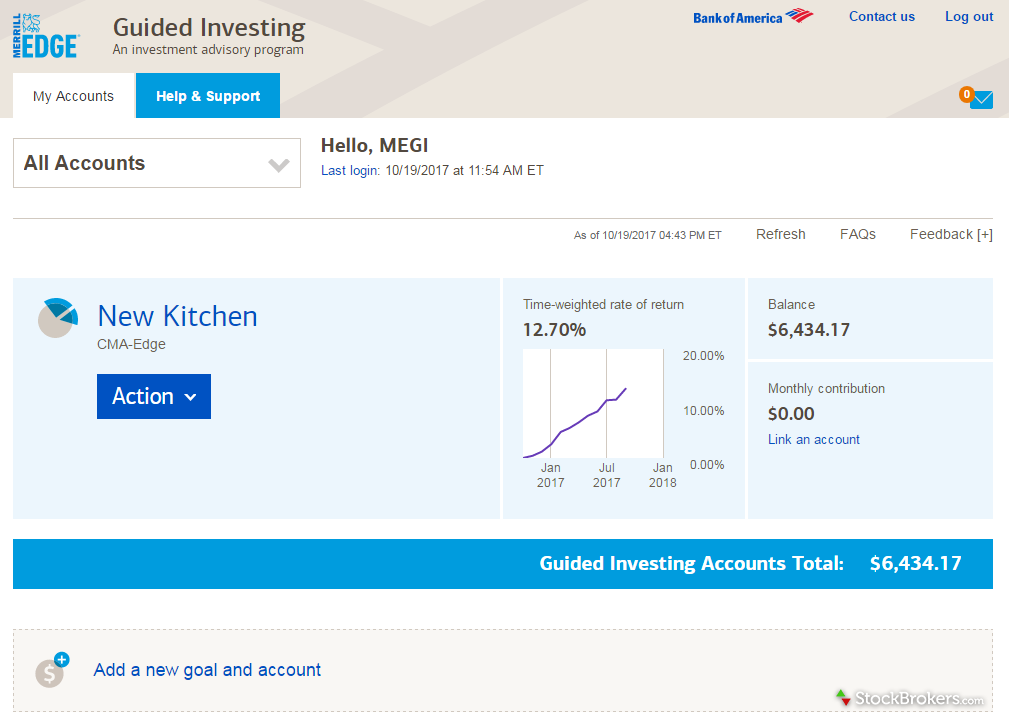

- Guided investing with a professional portfolio balances and managed by Merrill Lynch personnel for a 0.45% fee annually, with an investing minimum of $5,000

- Financial Advisor services, personalized to your goals and investment needs, for a 0.85% fee annually, with an investing minimum of $20,000

These are just a few examples. You can find the entire pricing system, which is transparent and easy to read, on their online platform.

Merrill Edge offers access to a number of features and mobile trading opportunities that allow you to stay on top of your investment goals. A number of mobile tools will help you have a clear picture of your account and investment plan. They want to make sure that the entire process is suited to your personal needs, and that you can always get the best possible solution.

For more active and experienced traders, Merrill Edge offers the MarketPro package that gives you total control over the investment decisions. Great customer service is available to all users, 24 hours a day, 7 days a week. You can contact them by phone or email.

Summary

The biggest advantage of Merrill Edge platform is the personalized service they offer to all their customers. They focus on building trust with their users by giving good advice, creating sound investment plans and helping with every aspect of the process. Customer support and lots of informative tools are also a plus. Although, one thing that is often overlooked is the always available access to mobile trading.

It is important to note that the website itself is not very user-friendly and a bit difficult to navigate. There are no virtual practice options for trading, which is not helpful for beginners.

In conclusion, Merrill Edge provides a well-rounded service, adjusted to your individual needs and preferences.

I together with my pals were actually looking through the nice suggestions on your web site and then then I had an awful feeling I never thanked the website owner for them. Most of the ladies were for that reason happy to see all of them and already have in actuality been taking advantage of those things. Appreciate your getting well kind and then for picking these kinds of really good information most people are really desirous to be aware of. My personal sincere apologies for not expressing gratitude to you sooner.