AVATrade is among the oldest Forex/CFD brokerages and as such, it is also one of the more controversial online trading destinations. Over the years, regulatory issues have piled up for the operator, as have trader complaints, of which there is no shortage when it comes to AVATrade. Let us take this one step at a time though, and take a closer peek first at the background of the operation, as well as its regulatory status.

AVATrade

Founded in 2006 (which was indeed ages ago, in online trading industry terms) AVATrade is based in Dublin, Ireland. Besides its main headquarters though, the operator maintains offices worldwide, in various major cities, such as Paris, Sydney, Beijing, Tokyo, Santiago, Madrid and Johannesburg, among others. This is by no means a two-bit operation and given that it’s been at it since 2006, it is hardly surprising that it is such a globally dominant force. AVATrade currently boasts more than 200,000 traders worldwide, who execute more than 2 million trades every month.

While the corporate strength of the operation and the trading volumes it handles are obvious indicators of trust too, perhaps more relevant in this regard is the regulatory status of the brokerage.

AVATrade’s Regulatory Profile

We never recommend that any of our readers should trade with unregistered and unregulated online brokerages, in any shape or form. The problem is though, that a solid regulatory profile cannot guarantee trader satisfaction either these days. In This regard, AVATrade’s affairs are indeed in top shape.

The operation is regulated by the Central Bank of Ireland – the home base of the company. The CBI license number of the operation is C53877. Furthermore, AVATrade Ltd is regulated by the BVI (British Virgin Islands) Financial Services Commission as well.

As most other such global brokerages, AVATrade operates through a number of subsidiaries, each of which handles issues linked to regulation in the specific ways called for by its home market.

The Australian branch of the operation, AVA Capital Markets Pty Ltd, is regulated by ASIC, under license No. 406684. The South African subsidiary is also called AVA Capital Markets Pty, and it is licensed by the FSB, under license No. 45984.

AVATrade Japan KK works under the guidelines set forth by the local FFA, and it possesses license No. 1574.

The AVATrade website offers full disclosure of risks associated with the activity it engages in. Would-be traders are advised to read into this risk disclosure document.

AVATrade Products

As said above, AVATrade offer Forex and CFD products. The Forex section offers a description of how Forex markets work, and it boasts Vanilla Options (which work a lot like binary options, but are nonetheless different in that they allow for unlimited profits and expose traders to potentially unlimited losses) and cryptocurrencies.

The CFD section on the other hand is much more generous. Through these contracts for difference, AVATrade clients can trade Indices, Stocks, Bonds, ETFs as well as commodities.

AVATrade Trading Conditions

Matured contracts are automatically turned over by the AVATrade system. The brokerage features full transparency in this regard: the rollover dates on every tradable asset are publicly available.

Information on how the rollovers are calculated is also available – there’s not much point in going into details on that here.

The FX spreads are rather substantial and this goes for the fixed as well as the floating versions. On major currency pairs, they go as low as 0.7 pips on the EUR/USD (floating) and 1.9 pips fixed. On exotics, there are spreads featured in excess of 100 pips. The maximum leverage on FX products is 400:1, on MetaTrader. The leverage is lower on the other platforms. The required margins also differ, from 0.25% on Metatrader, to 0.5% on AvaTrade. The overnight interest rates are minute, yet they can be significant over the long run, so it is best to check those too, before beginning to trade a given product.

On Cryptos, the spreads are obviously much bigger, the maximum leverage is as low as 2:1 and the margin requirements are much higher. The same goes for most of the other products. The spreads are notoriously large on options, too.

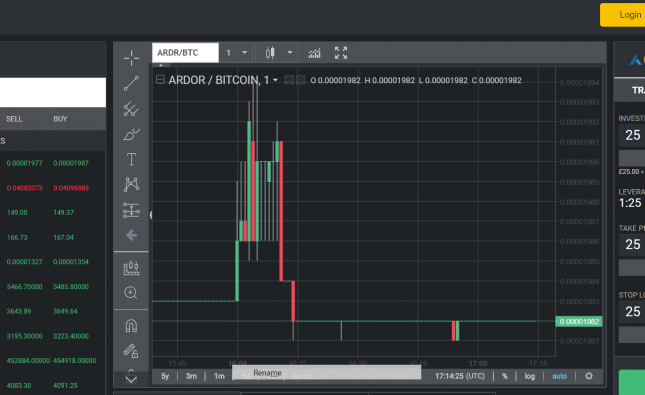

AVATrade Platforms

One of AVATrade’s unique draws stems from the autotrading features tossed into the package for free, by the brokerage. Auto-trading happens on a separate platform, which has been designed to support several copy trading solutions, such as ZuluTrade, DupliTrade and Mirror Trader – among others.

The brokerage features two MT4 platforms: one for floating spreads and another for fixed spreads.

The AVATradeAct platform is a proprietary solution, together with AVA Options. There are separate platforms for Mac Trading, Web Trading and Mobile Trading too. MT4 and AVATradeAct platforms are both available for mobile users, and they can be downloaded as separate apps.

Should I trust AVATrade?

This one is difficult to tell. The background and history of the operation should be trust-inspiring, though they too contain bits and pieces which are dubious, to say the least. Despite its superb regulatory status, the relationship of the operation with regulators was not always frictionless. The general public sentiment regarding the services offered by the brokerage is rather dismal as well.

Red Flags and Question Marks

Back in 2013, AVATrade had a problem with the FPA, regarding the provision of certain bits of essential information concerning the handling of arbitrage and off-market fill. The biggest red flag is raised by the community feedback though, which is really not favorable for the operator.

Complaints

Most of the complaints concerning AVATrade’s services are focused on the “terrible” customer service. People don’t like the fact that support isn’t too keen on helping them with their withdrawals. Some have even complained about the broker making it impossible for them to withdraw funds. AVATrade reps have made a visible effort to address most of these complaints, though some of them do sound rather scary and desperate. There are even voices out there calling the brokerage a “scam.”

AVATrade Review Conclusion

AVATrade look like a serious, solid and well-established operation, though some of their users will certainly disagree with that. Their trading conditions are decent as is their platform selection, and some love their copy trading features. It does appear however that their support staff might be a tad incompetent here and there. Some of their spreads are also quite ridiculously large.

What are your thoughts on AVATrade? Feel free to share them with us by leaving a comment below this review.