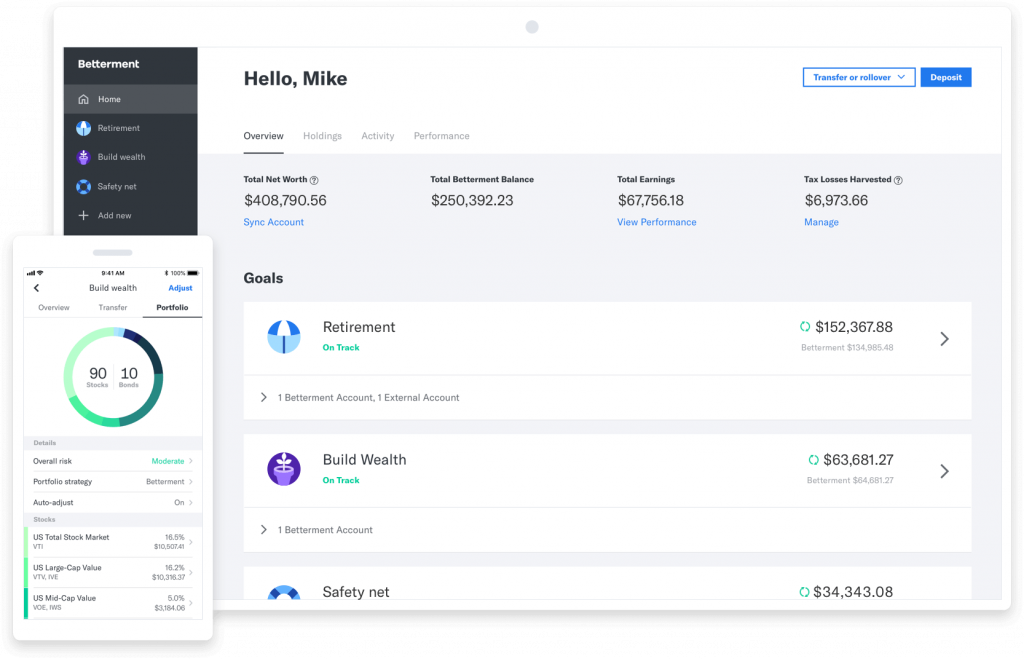

The Betterment app is a great resource for investors who want to take control of their finances from anywhere. The mobile platform has all the tools and capabilities of its web version, with easy access to your portfolio performance and management options at any time. This investing platform also offers low-cost stocks and ETFs that are suitable for new or seasoned investors alike. Whether you’re looking for automated deposits so you don’t have to make transactions manually or personalized financial advice, this investment tool will help you reach your goals in no time! Here are some of the reasons we love Betterment and think you will too.

What to Like About Betterment:

Automated Deposits – This feature makes investing easy for anyone, no matter how much or how little time they have to invest. The app takes it a step further by making this process simple and intuitive. Just select the portfolio that’s best for your needs, decide on a frequency for deposits (daily, weekly, monthly), input the amount you’d like to deposit each time, and confirm your account information. And voila! You’ve just set up automated deposits with no need to log in every day or make a transaction yourself. Account holders can also designate certain amounts to be automatically transferred from their PayPal accounts if they prefer.

Personalized Advice – According to Betterment, their process of “robo-advising” is “the smartest way to invest on your own.” To begin with, you take a free, in-depth assessment of your financial position and goals through the app. This step helps create a thoughtful Investment Policy Statement (IPS) that satisfies your goals and protects against market fluctuations. After that, the automated system makes recommendations based on your investment profile are tailored specifically for your needs. The advice includes specific ETFs from their lineup based on risk level and tax efficiency, along with any other services betterment offers such as estate planning or basic portfolio audits.

Diversification – Smart portfolio management means choosing the right investments that are meaningful and will last over time. If you’re interested in a wider range of stocks, Betterment makes this possible by offering low-cost diversified ETFs from reputable companies, such as Vanguard and iShares. These financial instruments track certain indexes and can provide even more benefits than individual stocks such as tax efficiency and cost savings.

Personalized Portfolios – One of the greatest strengths of Betterment is their ability to personalize portfolios in response to your current goals and needs. Your investment strategy will be tailored specifically for you when you create an account, including how much risk you want to take on the stock market at any given time. Whatever your comfort level is, Betterment has a portfolio to match.

Low Cost – According to the Betterment website, their fees for ETF and Vanguard index funds are $0.35 per month, which is comparable to many robo-advisors. But they also have additional services, including estate planning and portfolio reviews, that come at an additional cost. If you’re looking just for investment advice, their fee structure is simple and effective at 0.25% of assets under management annually. And while these fees may seem small on paper, taking advantage of their automated features can save investors as much as 2% in transaction costs each year (this number takes into account commissions from online brokers). This amount may sound trivial but can really make a difference when it comes to saving for retirement.

Final Thoughts on Betterment

Betterment is a great tool for anyone who wants to invest but doesn’t have the time or knowledge to do so. It offers diversified portfolios, personalized advice, and low fees that make investing simple and easy. Betterment can also be used by those with little experience in investing as well as seasoned investors looking for more personalization.